Prédiction du cours boursier#

Objectif

prédire le cours boursier à horizon 60 jours

comparer les modèles

Modèles choisis

ARMA

SARIMA

XGBoost

Extra Trees (variante de Random Forest)

Support Vector Machine (SVM)

Prophet

Tableau. Modèles de prédiction

Modèle |

Detrend |

Saisonnalité |

Type |

|---|---|---|---|

ARMA |

Moyenne mobile linéaire |

Moyenne mobile linéaire |

Série temporelle |

SARIMA |

Moyenne mobile linéaire |

Moyenne mobile linéaire |

Série temporelle |

XGBoost |

Régression linéaire |

Mensuelle |

Machine Learning |

ExtraTrees |

Régression linéaire |

Mensuelle |

Machine Learning |

Support Vector Machine |

Régression linéaire |

Mensuelle |

Machine Learning |

Prophet |

Pas de detrend |

Automatique |

Autre |

Critères d’évaluation

train / test split (test = 60 jours)

AIC

MSE

graphiquement (la courbe ne doit pas faire “n’importe quoi”)

Imports#

1import matplotlib.dates as mdates

2import matplotlib.pyplot as plt

3import numpy as np

4import pandas as pd

5import xgboost

6from prophet import Prophet

7from sklearn.ensemble import ExtraTreesRegressor

8from sklearn.linear_model import LinearRegression

9from sklearn.svm import SVR

10

11from src.data.load_data import load_processed_data, load_stock_data

12from src.regression.models.machine_learning_detrend import detrend_prediction

13from src.regression.models.sarima import sarimax

14from src.regression.plot import true_vs_prediction

15from src.regression.training.metrics import compute_metrics

16from src.utils.misc import init_notebook

1init_notebook()

1detrend_linear_ma_window100 = "detrend/LinearMADetrend/window-100"

2stock_name = "AAPL"

1df_detrend = load_processed_data(stock_name, detrend_linear_ma_window100)

1df_detrend.head()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2019-01-02 | -2.636750 | -1.646748 | -2.801751 | -1.879250 | -3.465916 | 148158800 |

| 2019-01-03 | -5.465638 | -5.030637 | -5.960637 | -5.913137 | -7.341764 | 365248800 |

| 2019-01-04 | -5.434760 | -4.429759 | -5.617259 | -4.502261 | -5.991877 | 234428400 |

| 2019-01-07 | -4.487831 | -4.455330 | -5.187832 | -4.680332 | -6.166622 | 219111200 |

| 2019-01-08 | -4.372408 | -3.807405 | -4.632406 | -4.074907 | -5.589533 | 164101200 |

1prediction_results_dict = {}

SARIMA#

1price_detrend = df_detrend["Close"]

Train test split#

1train_test_split_date = pd.Timestamp("2021-10-01")

2train, test = (

3 price_detrend[price_detrend.index <= train_test_split_date],

4 price_detrend[price_detrend.index > train_test_split_date],

5)

1model = sarimax(train)

2result = model.fit()

/home/runner/work/stock-analysis/stock-analysis/.venv/lib/python3.13/site-packages/statsmodels/tsa/base/tsa_model.py:473: ValueWarning: A date index has been provided, but it has no associated frequency information and so will be ignored when e.g. forecasting.

self._init_dates(dates, freq)

/home/runner/work/stock-analysis/stock-analysis/.venv/lib/python3.13/site-packages/statsmodels/tsa/base/tsa_model.py:473: ValueWarning: A date index has been provided, but it has no associated frequency information and so will be ignored when e.g. forecasting.

self._init_dates(dates, freq)

/home/runner/work/stock-analysis/stock-analysis/.venv/lib/python3.13/site-packages/statsmodels/base/model.py:607: ConvergenceWarning: Maximum Likelihood optimization failed to converge. Check mle_retvals

warnings.warn("Maximum Likelihood optimization failed to "

1print(result.summary())

SARIMAX Results

==============================================================================

Dep. Variable: Close No. Observations: 694

Model: SARIMAX(10, 0, 10) Log Likelihood -1419.635

Date: Wed, 15 Oct 2025 AIC 2881.270

Time: 12:40:12 BIC 2976.662

Sample: 0 HQIC 2918.160

- 694

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 0.9860 0.112 8.769 0.000 0.766 1.206

ar.L2 -0.0215 0.091 -0.236 0.813 -0.200 0.157

ar.L3 0.0526 0.095 0.551 0.582 -0.134 0.240

ar.L4 -0.0071 0.093 -0.077 0.939 -0.189 0.174

ar.L5 -0.0374 0.081 -0.459 0.646 -0.197 0.122

ar.L6 0.0583 0.091 0.638 0.524 -0.121 0.237

ar.L7 -0.0317 0.091 -0.349 0.727 -0.210 0.146

ar.L8 -0.1617 0.083 -1.938 0.053 -0.325 0.002

ar.L9 0.9649 0.111 8.717 0.000 0.748 1.182

ar.L10 -0.8306 0.086 -9.655 0.000 -0.999 -0.662

ma.L1 -0.1299 0.119 -1.095 0.274 -0.362 0.103

ma.L2 -0.0127 0.093 -0.137 0.891 -0.195 0.169

ma.L3 -0.0716 0.090 -0.797 0.426 -0.248 0.105

ma.L4 -0.0788 0.104 -0.758 0.448 -0.283 0.125

ma.L5 0.0334 0.100 0.333 0.739 -0.163 0.230

ma.L6 -0.0906 0.091 -0.997 0.319 -0.269 0.088

ma.L7 -0.0072 0.106 -0.068 0.946 -0.215 0.201

ma.L8 0.1326 0.100 1.331 0.183 -0.063 0.328

ma.L9 -0.8112 0.103 -7.841 0.000 -1.014 -0.608

ma.L10 0.1090 0.043 2.560 0.010 0.026 0.192

sigma2 3.5329 0.138 25.571 0.000 3.262 3.804

===================================================================================

Ljung-Box (L1) (Q): 0.00 Jarque-Bera (JB): 432.17

Prob(Q): 0.95 Prob(JB): 0.00

Heteroskedasticity (H): 6.79 Skew: 0.01

Prob(H) (two-sided): 0.00 Kurtosis: 6.87

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

1forecast_steps = len(test)

2forecast = result.get_forecast(steps=forecast_steps)

3predicted_values = forecast.predicted_mean

/home/runner/work/stock-analysis/stock-analysis/.venv/lib/python3.13/site-packages/statsmodels/tsa/base/tsa_model.py:837: ValueWarning: No supported index is available. Prediction results will be given with an integer index beginning at `start`.

return get_prediction_index(

/home/runner/work/stock-analysis/stock-analysis/.venv/lib/python3.13/site-packages/statsmodels/tsa/base/tsa_model.py:837: FutureWarning: No supported index is available. In the next version, calling this method in a model without a supported index will result in an exception.

return get_prediction_index(

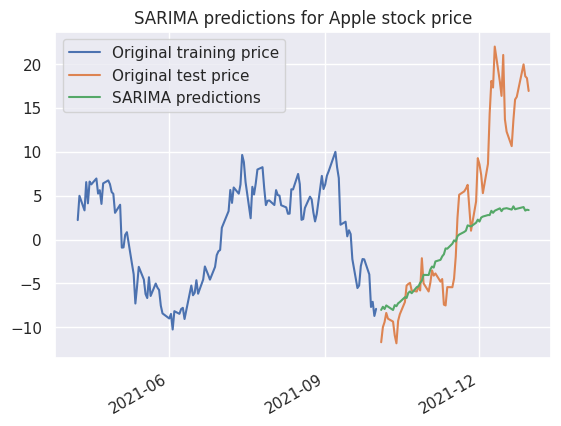

1plot_n_days_prior_pred = 2 * forecast_steps

2

3plt.plot(train[-plot_n_days_prior_pred:], label="Original training price")

4plt.plot(test, label="Original test price")

5plt.plot(test.index, predicted_values, label="SARIMA predictions")

6plt.title("SARIMA predictions for Apple stock price")

7plt.legend()

8

9

10# Display limited number of date index

11plt.gca().xaxis.set_major_locator(mdates.MonthLocator(interval=3))

12# Rotate x-axis labels

13plt.gcf().autofmt_xdate()

14

15plt.show()

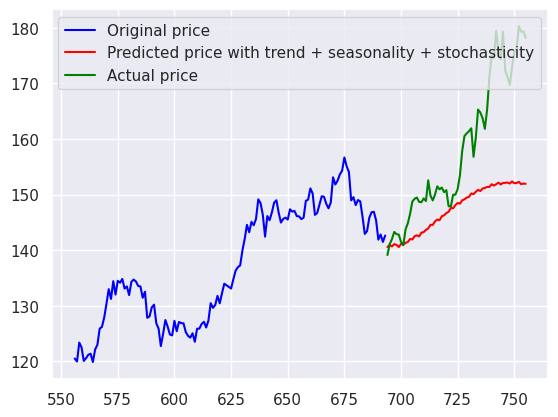

Prédiction du prix d’Apple à 2 mois#

Recomposons les prédictions du modèle SARIMA pour la stochasticité avec la tendance pour obtenir une prévision du cours d’Apple.

1original_data = load_stock_data(stock_name)

1# Get only close price

2original_price = original_data["Close"]

1# Train test split

2original_data_train, original_data_test = (

3 original_price[original_price.index <= train_test_split_date],

4 original_price[original_price.index > train_test_split_date],

5)

1# Drop time index in order to vanish weekend days issues

2original_data_train.reset_index(drop=True, inplace=True)

3original_data_test.reset_index(drop=True, inplace=True)

Tendance#

On reconstruit la tendance que l’on avait prédite par la méthode de la moyenne mobile.

1for i in range(forecast_steps):

2 rolling_mean = original_data_train.rolling(window=100, center=False).mean()

3 pred_trend = rolling_mean.iloc[-1]

4 pred_index = original_data_train.index[-1] + 1

5 original_data_train = pd.concat(

6 [original_data_train, pd.Series([pred_trend], index=[pred_index])]

7 )

1plt.plot(original_data_train.iloc[-300:-forecast_steps], label="Original price")

2plt.plot(

3 original_data_train.iloc[-forecast_steps:],

4 label="Predicted trend price",

5)

6plt.legend()

<matplotlib.legend.Legend at 0x7f3a93385310>

Saisonnalité et stochasticité#

1# Make SARIMA predicted values begin at zero

2predicted_values -= predicted_values.iloc[0]

1# Calculate trend + ARIMA

2add_components = original_data_train.iloc[-forecast_steps] + predicted_values

3

4# Put predicted data in train series set

5original_data_train.iloc[-forecast_steps:] = add_components

Evaluation de la prédiction#

1# Set index for test data i.e. actual data

2original_data_test.index = original_data_train.index[-forecast_steps:]

1plt.plot(

2 original_data_train.iloc[-200:-forecast_steps], color="blue", label="Original price"

3)

4plt.plot(

5 original_data_train.iloc[-forecast_steps:],

6 color="red",

7 label="Predicted price with trend + seasonality + stochasticity",

8)

9plt.plot(original_data_test, color="green", label="Actual price")

10plt.legend()

<matplotlib.legend.Legend at 0x7f3a90169450>

1y_true = original_data_test

2y_pred = original_data_train[-forecast_steps:]

1prediction_results_dict["SARIMA"] = compute_metrics(y_true, y_pred)

2prediction_results_dict["SARIMA"]

(10.698355198814452, 13.862575751530015)

XGBoost#

Traitement des données#

1type(original_data)

pandas.core.frame.DataFrame

1train_start = pd.Timestamp("2019-01-01")

2train_end = pd.Timestamp("2021-10-01")

3

4df_train = original_data.loc[train_start:train_end].copy()

5df_test = original_data.loc[train_end:].copy()

1type(df_train)

2df_train["time_dummy"] = np.arange(len(df_train))

3df_train

| Open | High | Low | Close | Adj Close | Volume | time_dummy | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2019-01-02 | 38.722500 | 39.712502 | 38.557499 | 39.480000 | 37.943256 | 148158800 | 0 |

| 2019-01-03 | 35.994999 | 36.430000 | 35.500000 | 35.547501 | 34.163822 | 365248800 | 1 |

| 2019-01-04 | 36.132500 | 37.137501 | 35.950001 | 37.064999 | 35.622250 | 234428400 | 2 |

| 2019-01-07 | 37.174999 | 37.207500 | 36.474998 | 36.982498 | 35.542965 | 219111200 | 3 |

| 2019-01-08 | 37.389999 | 37.955002 | 37.130001 | 37.687500 | 36.220528 | 164101200 | 4 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 2021-09-27 | 145.470001 | 145.960007 | 143.820007 | 145.369995 | 143.707413 | 74150700 | 689 |

| 2021-09-28 | 143.250000 | 144.750000 | 141.690002 | 141.910004 | 140.286987 | 108972300 | 690 |

| 2021-09-29 | 142.470001 | 144.449997 | 142.029999 | 142.830002 | 141.196472 | 74602000 | 691 |

| 2021-09-30 | 143.660004 | 144.380005 | 141.279999 | 141.500000 | 139.881668 | 89056700 | 692 |

| 2021-10-01 | 141.899994 | 142.919998 | 139.110001 | 142.649994 | 141.018539 | 94639600 | 693 |

694 rows × 7 columns

1df_train["time_dummy"] = np.arange(len(df_train))

2df_test["time_dummy"] = np.arange(len(df_test)) + len(df_train)

3df_train["day"] = df_train.index.day

4df_test["day"] = df_test.index.day

1df_train["time_dummy"].tail()

Date

2021-09-27 689

2021-09-28 690

2021-09-29 691

2021-09-30 692

2021-10-01 693

Name: time_dummy, dtype: int64

1df_test["time_dummy"].head()

Date

2021-10-01 694

2021-10-04 695

2021-10-05 696

2021-10-06 697

2021-10-07 698

Name: time_dummy, dtype: int64

1x_col = ["time_dummy", "day"]

2y_col = ["Close"]

1x_train = df_train[x_col]

2y_train = df_train[y_col]

1x_test = df_test[x_col]

2y_test = df_test[y_col]

Apprentissage des modèles#

1lr = LinearRegression()

2lr.fit(x_train, y_train)

3y_residuals = y_train - lr.predict(x_train)

1xgb = xgboost.XGBRegressor(random_state=0, n_jobs=-2, colsample_bytree=0.3, max_depth=3)

2xgb.fit(x_train, y_residuals)

XGBRegressor(base_score=None, booster=None, callbacks=None,

colsample_bylevel=None, colsample_bynode=None,

colsample_bytree=0.3, device=None, early_stopping_rounds=None,

enable_categorical=False, eval_metric=None, feature_types=None,

feature_weights=None, gamma=None, grow_policy=None,

importance_type=None, interaction_constraints=None,

learning_rate=None, max_bin=None, max_cat_threshold=None,

max_cat_to_onehot=None, max_delta_step=None, max_depth=3,

max_leaves=None, min_child_weight=None, missing=nan,

monotone_constraints=None, multi_strategy=None, n_estimators=None,

n_jobs=-2, num_parallel_tree=None, ...)In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Parameters

| objective | 'reg:squarederror' | |

| base_score | None | |

| booster | None | |

| callbacks | None | |

| colsample_bylevel | None | |

| colsample_bynode | None | |

| colsample_bytree | 0.3 | |

| device | None | |

| early_stopping_rounds | None | |

| enable_categorical | False | |

| eval_metric | None | |

| feature_types | None | |

| feature_weights | None | |

| gamma | None | |

| grow_policy | None | |

| importance_type | None | |

| interaction_constraints | None | |

| learning_rate | None | |

| max_bin | None | |

| max_cat_threshold | None | |

| max_cat_to_onehot | None | |

| max_delta_step | None | |

| max_depth | 3 | |

| max_leaves | None | |

| min_child_weight | None | |

| missing | nan | |

| monotone_constraints | None | |

| multi_strategy | None | |

| n_estimators | None | |

| n_jobs | -2 | |

| num_parallel_tree | None | |

| random_state | 0 | |

| reg_alpha | None | |

| reg_lambda | None | |

| sampling_method | None | |

| scale_pos_weight | None | |

| subsample | None | |

| tree_method | None | |

| validate_parameters | None | |

| verbosity | None |

1y_pred_train = detrend_prediction(xgb, lr, x_train)

2y_pred_test = detrend_prediction(xgb, lr, x_test)

3prediction_results_dict["XGBoost"] = compute_metrics(y_test, y_pred_test)

4prediction_results_dict["XGBoost"]

(9.821550637003275, 13.252235166510234)

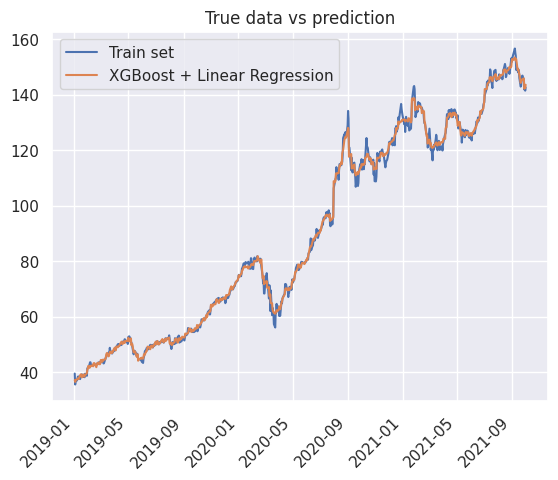

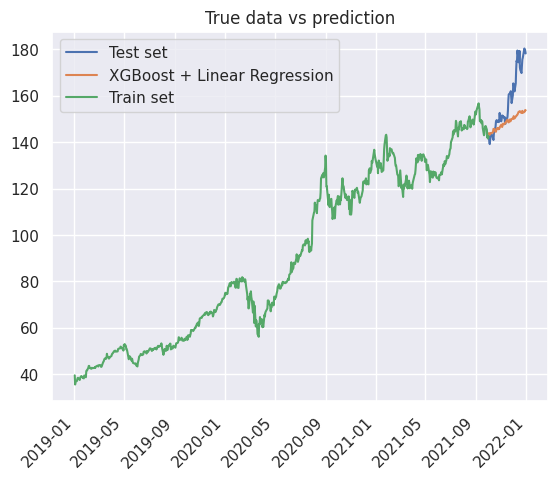

1_ = true_vs_prediction(

2 df_train["Close"],

3 y_pred_train,

4 true_label="Train set",

5 prediction_label="XGBoost + Linear Regression",

6)

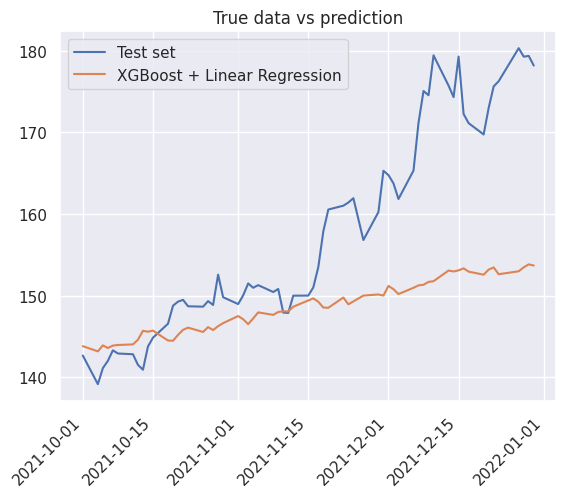

1_ = true_vs_prediction(

2 df_test["Close"],

3 y_pred_test,

4 true_label="Test set",

5 prediction_label="XGBoost + Linear Regression",

6)

1true_vs_prediction(

2 df_test["Close"],

3 y_pred_test,

4 true_label="Test set",

5 prediction_label="XGBoost + Linear Regression",

6)

7plt.plot(df_train["Close"], label="Train set")

8plt.legend()

<matplotlib.legend.Legend at 0x7f3a900e6d50>

Extra Trees#

Apprentissage des modèles#

1et = ExtraTreesRegressor(random_state=0, n_jobs=-2)

2et.fit(x_train, y_residuals)

/home/runner/work/stock-analysis/stock-analysis/.venv/lib/python3.13/site-packages/sklearn/base.py:1365: DataConversionWarning: A column-vector y was passed when a 1d array was expected. Please change the shape of y to (n_samples,), for example using ravel().

return fit_method(estimator, *args, **kwargs)

ExtraTreesRegressor(n_jobs=-2, random_state=0)In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook.

On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Parameters

| n_estimators | 100 | |

| criterion | 'squared_error' | |

| max_depth | None | |

| min_samples_split | 2 | |

| min_samples_leaf | 1 | |

| min_weight_fraction_leaf | 0.0 | |

| max_features | 1.0 | |

| max_leaf_nodes | None | |

| min_impurity_decrease | 0.0 | |

| bootstrap | False | |

| oob_score | False | |

| n_jobs | -2 | |

| random_state | 0 | |

| verbose | 0 | |

| warm_start | False | |

| ccp_alpha | 0.0 | |

| max_samples | None | |

| monotonic_cst | None |

1y_pred_test = detrend_prediction(et, lr, x_test)

2prediction_results_dict["ExtraTrees"] = compute_metrics(y_test, y_pred_test)

3prediction_results_dict["ExtraTrees"]

(9.74557499696818, 13.20182282007082)

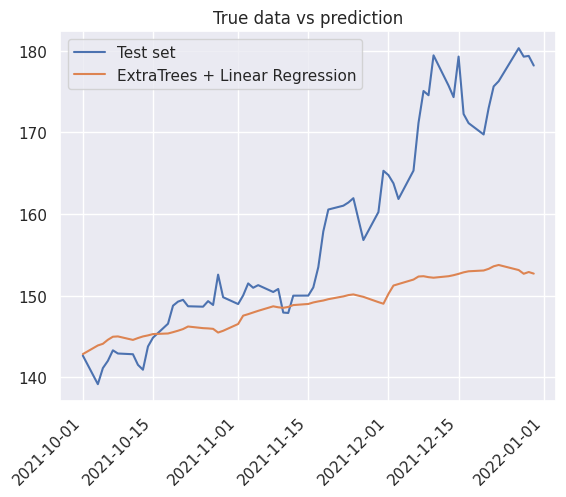

1_ = true_vs_prediction(

2 df_test["Close"],

3 y_pred_test,

4 true_label="Test set",

5 prediction_label="ExtraTrees + Linear Regression",

6)

SVM#

Apprentissage des modèles#

1svr = SVR()

2svr.fit(x_train, y_residuals)

/home/runner/work/stock-analysis/stock-analysis/.venv/lib/python3.13/site-packages/sklearn/utils/validation.py:1406: DataConversionWarning: A column-vector y was passed when a 1d array was expected. Please change the shape of y to (n_samples, ), for example using ravel().

y = column_or_1d(y, warn=True)

SVR()In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook.

On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Parameters

| kernel | 'rbf' | |

| degree | 3 | |

| gamma | 'scale' | |

| coef0 | 0.0 | |

| tol | 0.001 | |

| C | 1.0 | |

| epsilon | 0.1 | |

| shrinking | True | |

| cache_size | 200 | |

| verbose | False | |

| max_iter | -1 |

1y_pred_test = detrend_prediction(svr, lr, x_test)

2prediction_results_dict["Support Vector Machine"] = compute_metrics(y_test, y_pred_test)

3prediction_results_dict["Support Vector Machine"]

(8.73950426028892, 10.297525832287155)

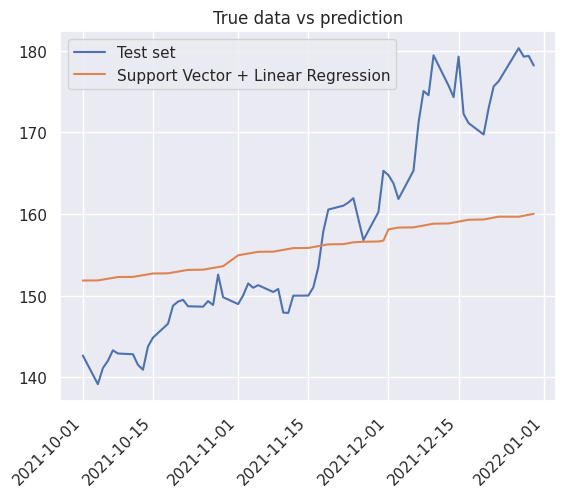

1_ = true_vs_prediction(

2 df_test["Close"],

3 y_pred_test,

4 true_label="Test set",

5 prediction_label="Support Vector + Linear Regression",

6)

Prophet#

Pré-traitement pour Prophet#

1x_train_prophet = pd.DataFrame(

2 {

3 "ds": x_train.index,

4 "y": df_train["Close"].values,

5 }

6)

7

8x_test_prophet = pd.DataFrame(

9 {

10 "ds": x_test.index,

11 "y": df_test["Close"].values,

12 }

13)

1x_test_prophet.head()

| ds | y | |

|---|---|---|

| 0 | 2021-10-01 | 142.649994 |

| 1 | 2021-10-04 | 139.139999 |

| 2 | 2021-10-05 | 141.110001 |

| 3 | 2021-10-06 | 142.000000 |

| 4 | 2021-10-07 | 143.289993 |

Prédiction#

Calcul de la prédiction#

1model = Prophet()

2model.fit(x_train_prophet)

12:40:14 - cmdstanpy - INFO - Chain [1] start processing

12:40:14 - cmdstanpy - INFO - Chain [1] done processing

<prophet.forecaster.Prophet at 0x7f3a974db8c0>

1forecast = model.predict(x_test_prophet)

2forecast[["ds", "yhat", "yhat_lower", "yhat_upper"]].tail()

| ds | yhat | yhat_lower | yhat_upper | |

|---|---|---|---|---|

| 58 | 2021-12-23 | 163.485849 | 157.429297 | 169.888856 |

| 59 | 2021-12-27 | 164.851525 | 158.423615 | 171.336812 |

| 60 | 2021-12-28 | 165.169482 | 158.395403 | 171.728886 |

| 61 | 2021-12-29 | 165.506546 | 159.233661 | 171.649162 |

| 62 | 2021-12-30 | 165.524170 | 159.169593 | 172.744326 |

1prediction_results_dict["Prophet"] = compute_metrics(

2 x_test_prophet["y"], forecast["yhat"]

3)

4prediction_results_dict["Prophet"]

(7.378329691676633, 9.228347960218333)

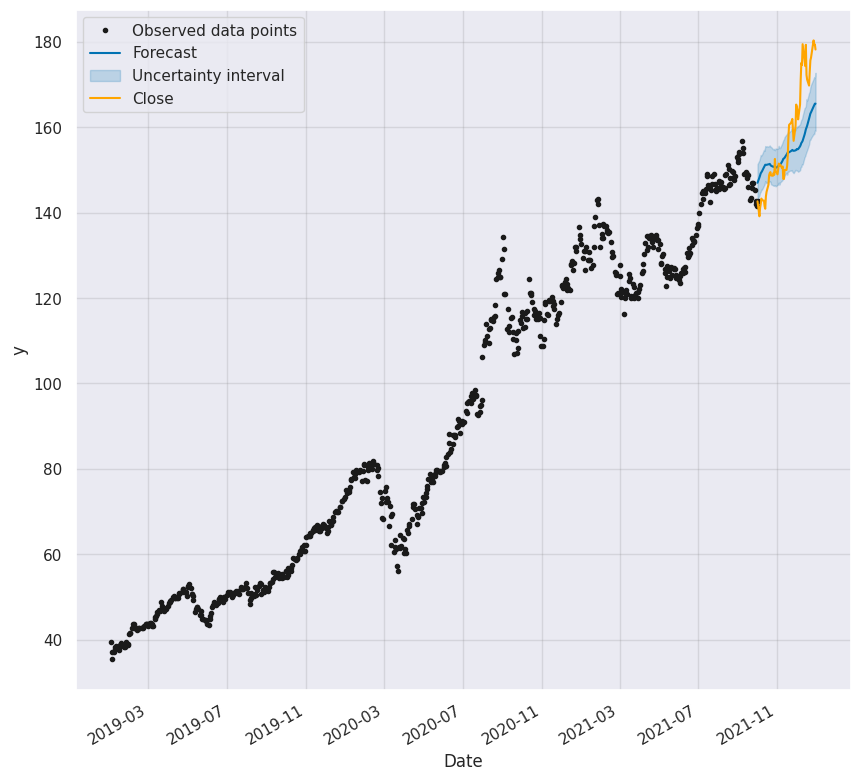

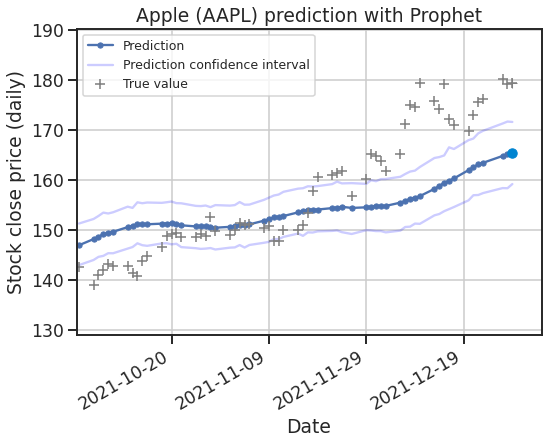

Affichage de la prédiction#

1fig, ax1 = plt.subplots(figsize=(10, 10))

2fig1 = model.plot(forecast, ax=ax1)

3# plt.scatter(forecast["ds"],df_test["Close"], color="orange", s=10, label="Close")

4df_test["Close"].plot(ax=ax1, color="orange")

5plt.legend()

/home/runner/work/stock-analysis/stock-analysis/.venv/lib/python3.13/site-packages/pandas/plotting/_matplotlib/core.py:981: UserWarning: This axis already has a converter set and is updating to a potentially incompatible converter

return ax.plot(*args, **kwds)

<matplotlib.legend.Legend at 0x7f3a97526d50>

Animation#

1# Tailwind CSS colors

2sky600 = "#0084d1"

3orange600 = "#f54900"

1import matplotlib.animation as animation

2import matplotlib.dates as mdates

1x = np.array(range(len(forecast["ds"])))

2y_pred = forecast["yhat"]

3y_lower = forecast["yhat_lower"]

4y_upper = forecast["yhat_upper"]

5x_dates = forecast["ds"]

6x = mdates.date2num(x_dates)

7

8y_true = x_test_prophet["y"]

9

10xmin, xmax, ymin, ymax = np.min(x), np.max(x), np.min(y_pred), np.max(y_pred)

1import seaborn as sns

2

3sns.set_theme(context="talk", style="ticks", rc={"axes.grid": True})

1fig = plt.figure(figsize=(8, 6), dpi=75)

2

3plt.title("Apple (AAPL) prediction with Prophet")

4plt.xlabel("Date")

5plt.ylabel("Stock close price (daily)")

6plt.gca().xaxis.set_major_formatter(mdates.DateFormatter("%Y-%m-%d"))

7plt.gcf().autofmt_xdate()

8

9# initialise la figure

10(line_pred,) = plt.plot(

11 [],

12 [],

13 label="Prediction",

14 marker="o",

15 markersize=5,

16)

17(line_pred_upper,) = plt.plot(

18 [], [], label="Prediction confidence interval", color="blue", alpha=0.2

19)

20(line_pred_lower,) = plt.plot([], [], color="blue", alpha=0.2)

21(line_true,) = plt.plot(

22 [],

23 [],

24 label="True value",

25 ls="none",

26 marker="+",

27 markersize=10,

28 color="gray",

29 markeredgewidth=1.5,

30)

31

32(point_pred,) = plt.plot([], [], ls="none", marker="o", color=sky600)

33(point_true,) = plt.plot([], [], ls="none", marker="+", markersize=10, color="gray")

34

35plt.legend(loc="upper left", fontsize=12)

36

37plt.xlim(xmin, xmax)

38plt.ylim(ymin, ymax)

39

40padding_x = 5

41padding_y = 10

42

43

44def animate(i: int):

45 x_data = x[: i + 1]

46 y_data = (y_pred[: i + 1], y_true[: i + 1], y_upper[: i + 1], y_lower[: i + 1])

47 xmin, xmax, ymin, ymax = (

48 np.min(x_data) - padding_x / 10,

49 np.max(x_data) + padding_x,

50 np.min(np.concatenate(y_data)) - padding_y,

51 np.max(np.concatenate(y_data)) + padding_y,

52 )

53 plt.xlim(xmin, xmax)

54 plt.ylim(ymin, ymax)

55

56 point_pred.set_data(x[i - 1 : i], y_pred[i - 1 : i])

57 line_pred.set_data(x[:i], y_pred[:i])

58 line_pred_upper.set_data(x[:i], y_upper[:i])

59 line_pred_lower.set_data(x[:i], y_lower[:i])

60

61 point_true.set_data(x[i - 1 : i], y_true[i - 1 : i])

62 line_true.set_data(x[:i], y_true[:i])

63

64 return line_pred, line_true

65

66

67ani = animation.FuncAnimation(

68 fig, animate, frames=len(x), interval=1, blit=True, repeat=False

69)

70ani.save("assets/img/prophet-prediction.gif")

MovieWriter ffmpeg unavailable; using Pillow instead.

1plt.rcParams["axes.prop_cycle"].by_key()["color"]

[(0.2980392156862745, 0.4470588235294118, 0.6901960784313725),

(0.8666666666666667, 0.5176470588235295, 0.3215686274509804),

(0.3333333333333333, 0.6588235294117647, 0.40784313725490196),

(0.7686274509803922, 0.3058823529411765, 0.3215686274509804),

(0.5058823529411764, 0.4470588235294118, 0.7019607843137254),

(0.5764705882352941, 0.47058823529411764, 0.3764705882352941),

(0.8549019607843137, 0.5450980392156862, 0.7647058823529411),

(0.5490196078431373, 0.5490196078431373, 0.5490196078431373),

(0.8, 0.7254901960784313, 0.4549019607843137),

(0.39215686274509803, 0.7098039215686275, 0.803921568627451)]

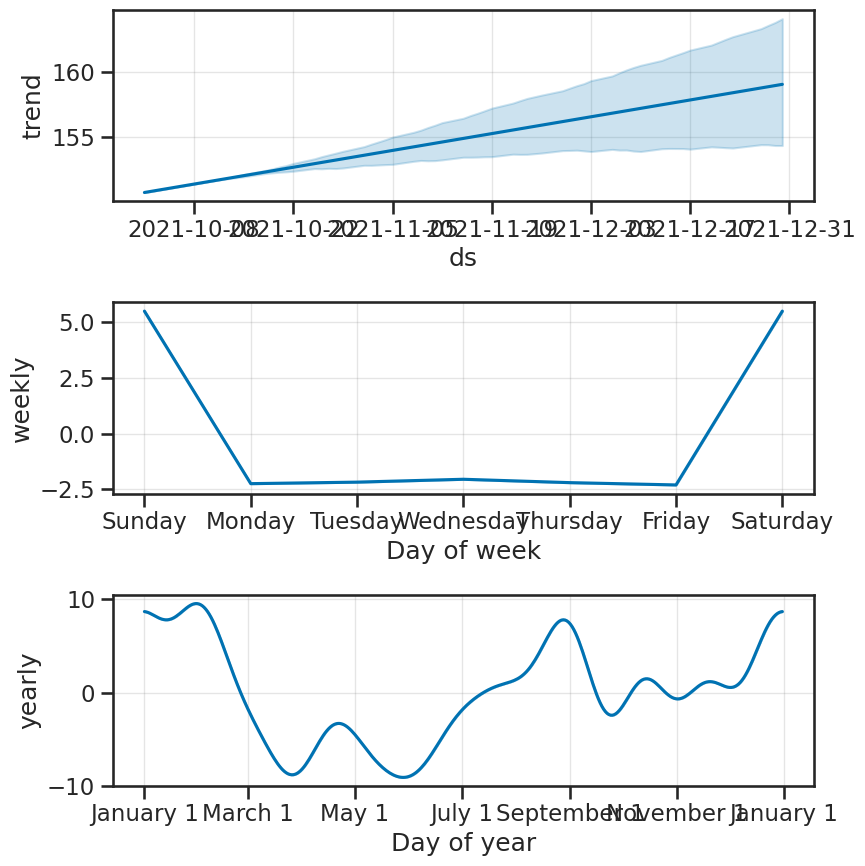

Décomposition#

1fig2 = model.plot_components(forecast)

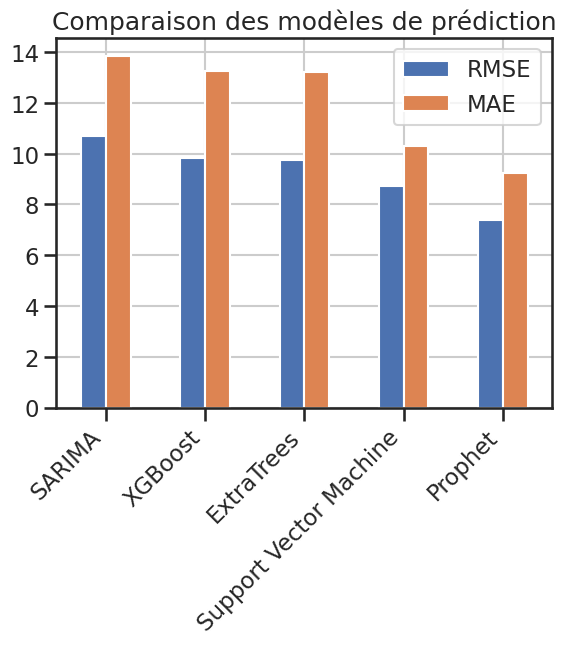

Comparaison des modèles#

1prediction_results_df = pd.DataFrame(prediction_results_dict).T

2prediction_results_df.columns = ["RMSE", "MAE"]

3# prediction_results_df

1prediction_results_df.plot(kind="bar")

2plt.title("Comparaison des modèles de prédiction")

3

4plt.xticks(rotation=45, ha="right")

(array([0, 1, 2, 3, 4]),

[Text(0, 0, 'SARIMA'),

Text(1, 0, 'XGBoost'),

Text(2, 0, 'ExtraTrees'),

Text(3, 0, 'Support Vector Machine'),

Text(4, 0, 'Prophet')])

1# print(prediction_results_df.to_markdown())

Tableau. Comparaison des modèles de prédiction

RMSE |

MAE |

Graphiquement |

|

|---|---|---|---|

ARMA |

17.3524 |

14.9797 |

✅ |

SARIMA |

13.6817 |

11.6047 |

✅ |

XGBoost |

13.2914 |

9.85264 |

✅ |

ExtraTrees |

13.2018 |

9.74557 |

✅ |

Support Vector Machine |

10.2975 |

8.7395 |

❌ |

Prophet |

8.97155 |

7.26206 |

✅ |

Meilleur modèle : Prophet